All DataHaven Programs, Community Wellbeing Survey, Economy

DataHaven survey finds food insecurity nearly doubled in Connecticut in 2022

Update: The 2022 statewide data crosstab is posted here.

PRESS RELEASE – SEPTEMBER 16, 2022

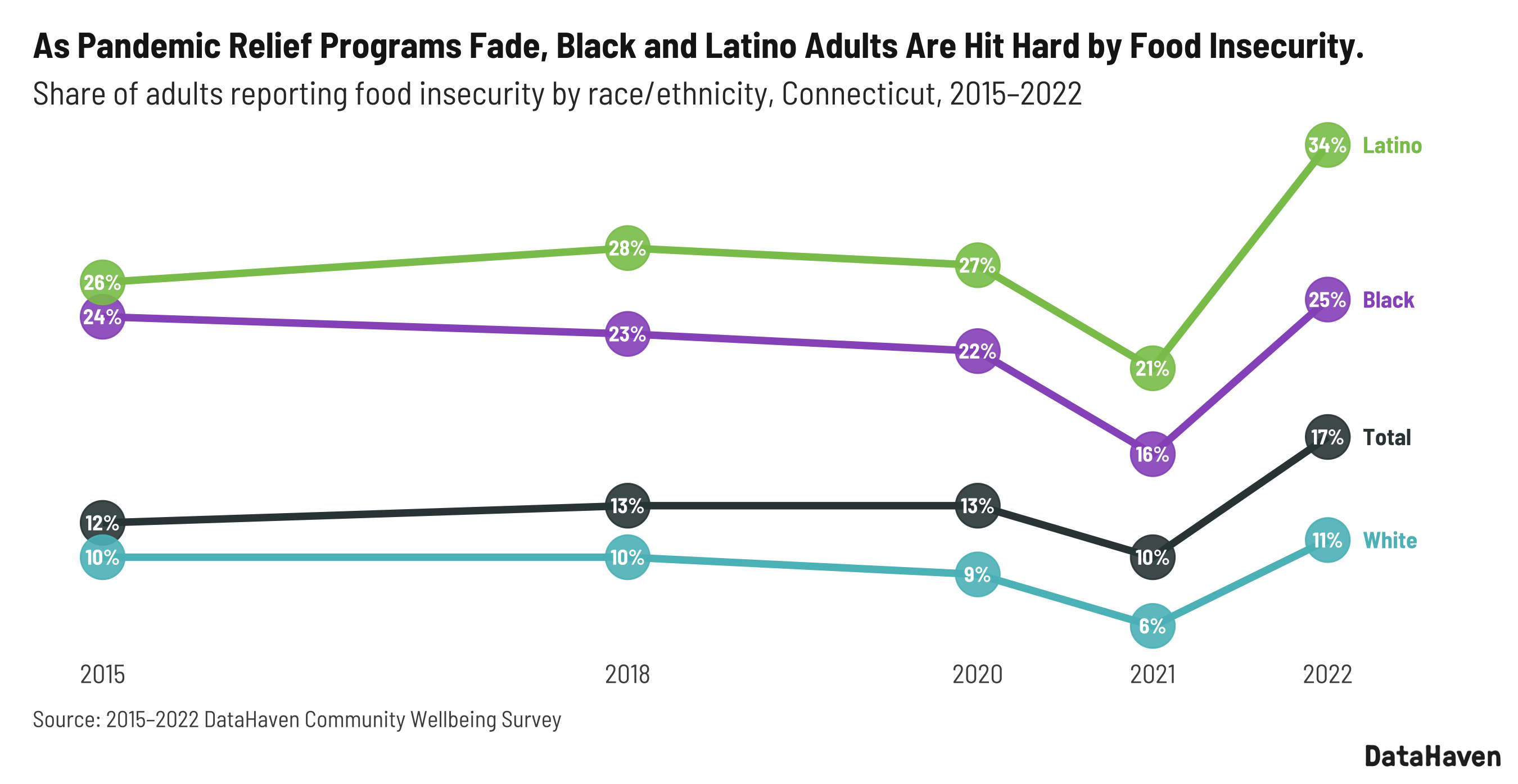

The percentage of Connecticut adults who say they did not have enough money to buy food has nearly doubled during the past year, according to new data released today by DataHaven from its comprehensive statewide well-being survey. The rate of food insecurity as of August 2022, at 17 percent of adults, is higher than the rate measured by DataHaven in 2015, 2018, mid-2020, and 2021. In 2021, just 10 percent of Connecticut adults reported food insecurity.

In August 2022, DataHaven and the Siena College Research Institute completed 1,196 interviews of randomly-selected adults in every Connecticut town. Conducted on behalf of dozens of public and private partners throughout the state, the DataHaven Community Wellbeing Survey involves live cell phone and landline interviews, and results are statistically weighted with oversampling in hard-to-reach areas. The 2022 survey is the sixth such effort over the past decade by DataHaven, a non-profit research organization based in New Haven that regularly publishes granular, neighborhood-level information based on tens of thousands of in-depth interviews as well as other public data sources. The 2022 survey carries a maximum margin of error of 3.2 percent.

DataHaven released the preliminary set of data on changes in food insecurity from 2015 through August 2022 today, as well as results from a survey question about the impact of inflation on household spending habits. As with previous survey waves, the full survey contains questions on a wide range of topics such as economic security, health, safety, and quality of life. A full report and final dataset is expected to be published by DataHaven in early 2023.

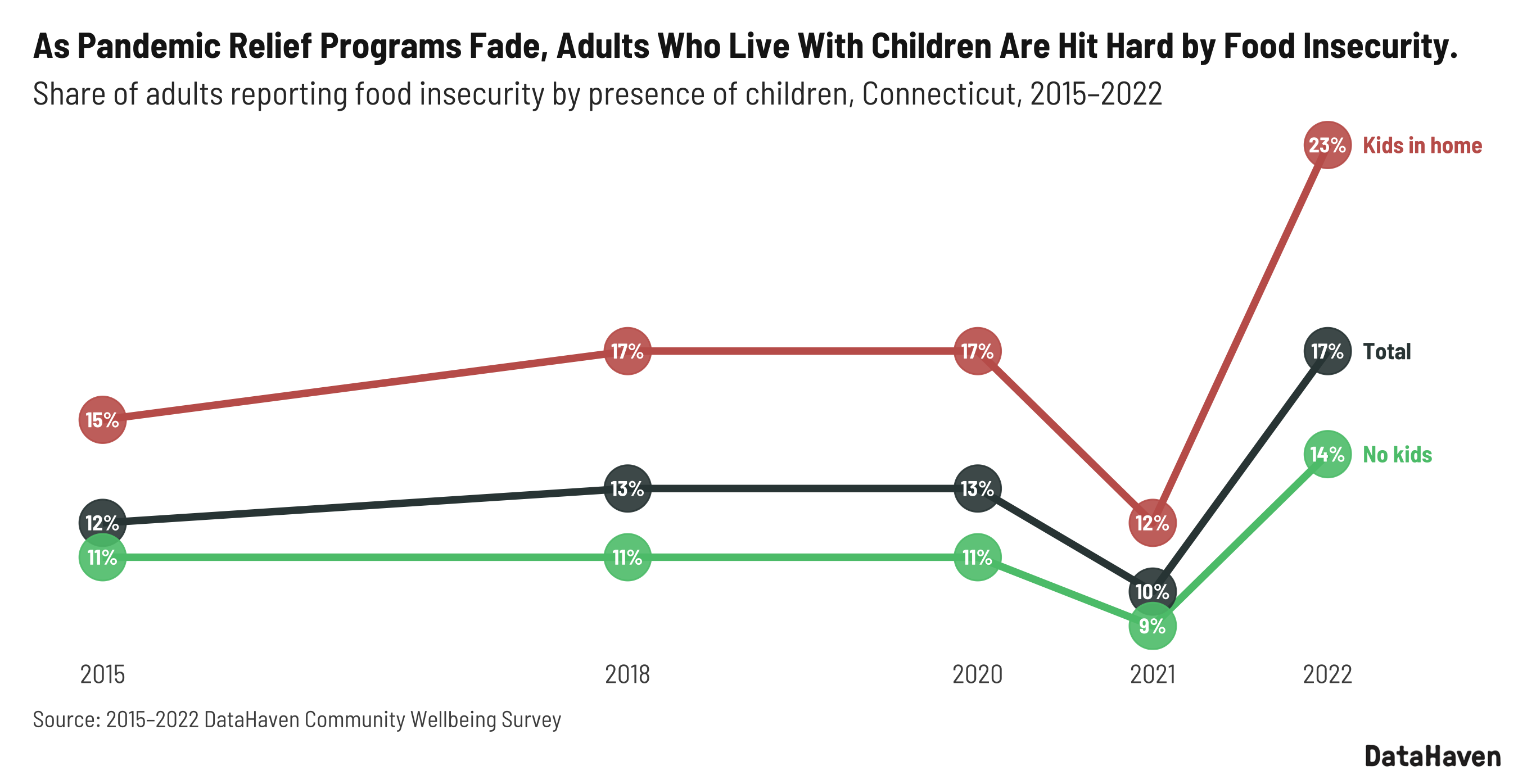

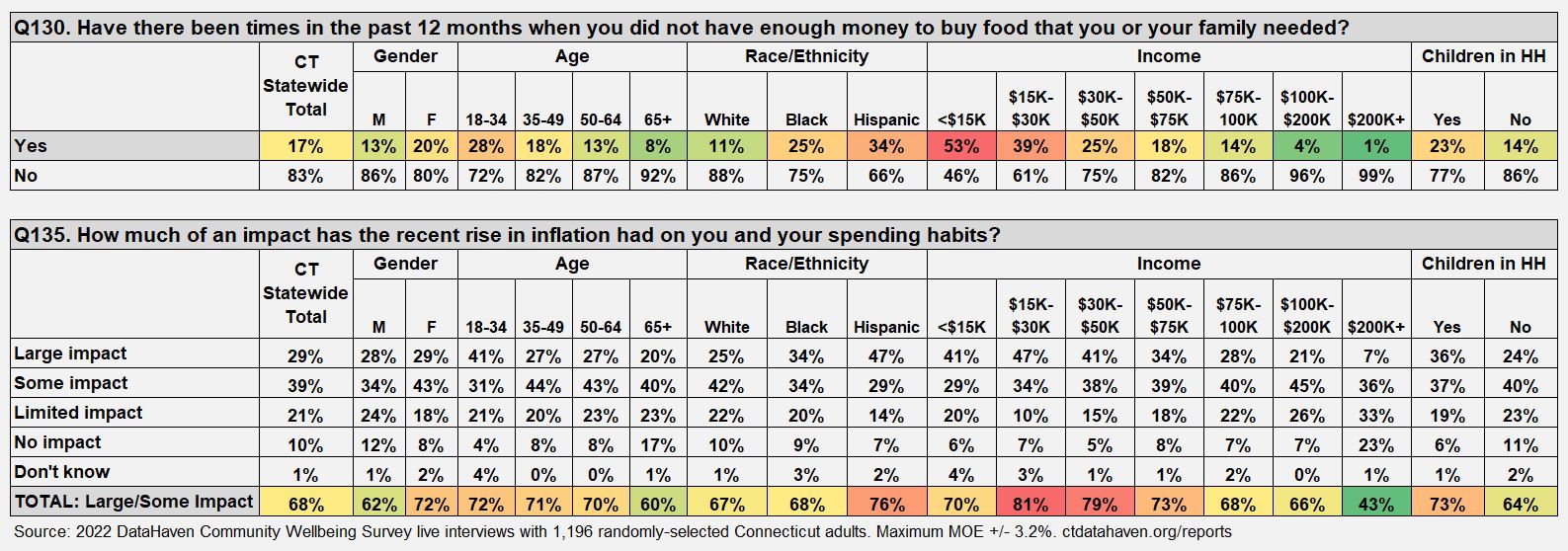

In the 2022 survey, the overall food insecurity rate of 17 percent masks large differences across Connecticut by race, gender, age, income, disability, and other factors. For example, approximately 11 percent of white, 25 percent of Black, and 34 percent of Latino adults reported food insecurity in the past year. Rates varied from 13 percent among men to 20 percent among women, and from 14 percent among adults living without children to 23 percent among adults living with children. More than a quarter of young adults age 18 to 34 reported food insecurity.

DataHaven’s findings on food insecurity mirror those of national studies. There has been a gradual rise in food insecurity almost every month since the end of 2021 among households living with children (Raifman, 2022). In particular, the increase in food insecurity coincides with the end of the Child Tax Credit (CTC), which provided large advance payments to nearly all U.S. families with dependent children (including those previously excluded from eligibility) each month beginning in July 2021 and ending in December 2021.

The Child Tax Credit is widely considered to have had a significant impact on the financial well-being of families with children in the United States in 2021. For example, researchers used a difference-in-differences approach comparing households with and without children to find that the start of the CTC was associated with a 16% to 26% reduction in food insufficiency in 2021 (Shafer et al., 2022), and another study found that child poverty nationally rose by nearly 50% after December 2021, resulting in 3.7 million additional children suddenly falling into poverty when the CTC program expired (Columbia University Center on Poverty and Social Policy, 2022). The CTC and other programs like it are associated with significant benefits to health, nutrition, and financial well-being, especially among low- and moderate-income families and racial and ethnic minorities (Grinstein-Weiss et al., 2022).

In the DataHaven survey, most households experiencing food insecurity also reported that they have been impacted by the recent rise in inflation. Overall, 68 percent of Connecticut adults say that inflation has had at least some impact on their spending habits, but this ranges from 43 percent among adults earning $200,000 or more to 80 percent among adults earning $30,000 or less (see table below). Although inflation has likely contributed to the rise in food insecurity, the significant drop in food insecurity observed by DataHaven and national researchers in 2021, especially among households with children, suggests that the expiration of the Child Tax Credit may be among the most significant drivers behind this year’s sharp increase.